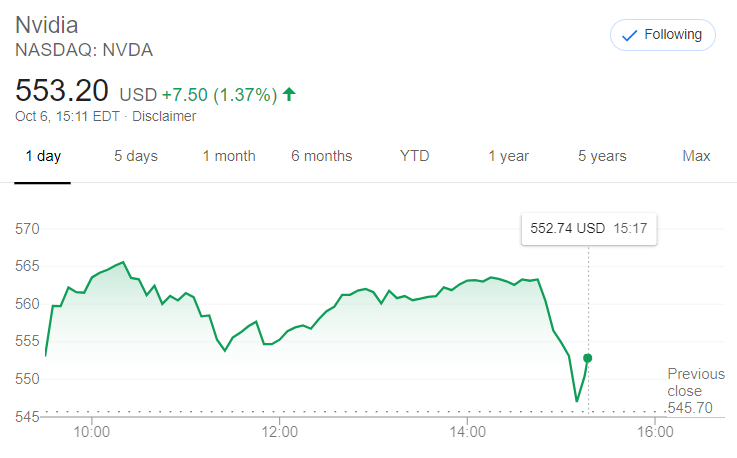

For the last week, the stock has had daily average volatility of 4.78%. During the last day, the stock moved $4.06 between high and low, or 3.00%. This stock has average movements during the day and with good trading volume, the risk is considered to be medium. NVIDIA finds support from accumulated volume at $132.61 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested. This causes a divergence between volume and price and it may be an early warning. Volume fell during the last trading day despite gaining prices. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD). Further rise is indicated until a new top pivot has been found. A buy signal was issued from a pivot bottom point on Friday, October 14, 2022, and so far it has risen 20.63%. A breakdown below any of these levels will issue sell signals.

On corrections down, there will be some support from the lines at $132.58 and $126.08.

Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average. The NVIDIA stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Mostly positive signals in the chart today.

0 kommentar(er)

0 kommentar(er)